Investment and tax expenses Many people forget tax planning and investment expenses because they're part of miscellaneous itemized expenses. Their total must exceed 2% of your adjusted gross income before you get any tax break.

Not only that fund raisers like car charity will be help improve lives of Americans, it could also be helpful to other people living in other countries as there are foundations that focus programs to help them. heritage for the blind are examples of groups that are very easy to deal with and they are likewise very open to your questions.

Third, donors are under the illusion that they get to reduce their tax. This is false. You get to reduce only the income that is taxed. Those are two different things. So what I do I recommend, you do with your used car?

That being said, your first order of business should be enlisting the help of others. As long as you choose people that are willing to commit to your cause you will be on your way to planning a great charity event without having to completely sacrifice your other responsibilities.

Also, you have all rights to find out what will charity organization do with your vehicle. Some will use donated car for a transport of poor people in need, while other will sell a car to raise funds. In any case, you have every right to get information about their plans for a car. If you don't receive a reasonable response, maybe you should change charity organization.

However, there are cautions to be observed when donating your car to a donation center. While you will be giving your car away you will definitely want to make good some benefit you will receive by way of tax benefits. You will only be able to avail of these benefits if you donate car to a charity listed with the IRS. If the car donation center or the charity your car lands up with are not listed with the IRS you will not be able to claim tax deductions on the transaction. So, this is the first thing your should ensure.

Website Expenses - Don't forget your website expenses as part of your deductible business expenses. Web hosting, domain name, and software are all deductible expenses. If you paid someone to design your site, don't forget that in your business expenses. However, there are some specific rules on website design costs.

For those charities that are not set up to handle donations they hire companies that are set up to resell your car, usually called car donation brokers through donate car ohio programs. If you seek them out know that they may keep 50 percent or more of the value of the vehicle. However since so many charities aren't set up to handle these donations they hire them and get profits they wouldn't ordinarily get, so the charity does gain some monies. You can always ask the broker how much of the profit is passed on to the charitable organization.

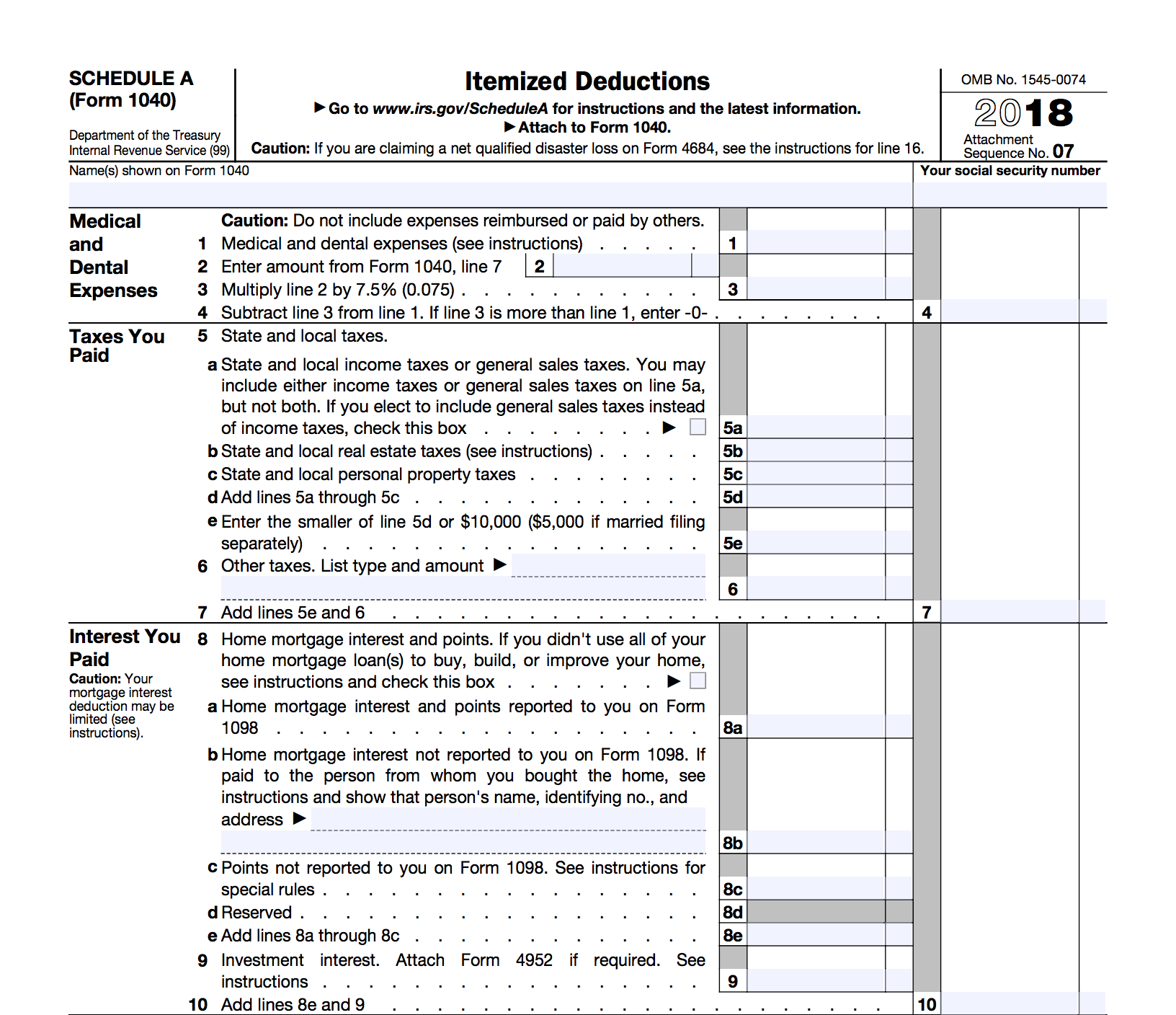

If you're married, the IRS gives you a standard deduction of more than $10,000 each year. And all this means is that you only get a tax deduction when your mortgage and all local state income taxes exceed $10,000. So for most Americans they don't qualify for this as they don't exceed this limit.

A tax deduction also reduces your gross income for tax purposes. The difference between it and an exemption is the amount of the deduction changes depending upon your circumstances. Let's consider the business mileage deduction. The deduction is determined by the amount of miles you claim multiplied by a figure issued by the IRS. In 2010, for instance, that figure was 50 cents a mile. The amount of your deduction is entirely dependent upon how many miles you drive. Since it will be different if you drove 1,000 or 10,000 miles, the reduction is known as a deduction versus an exemption.